No summer slow down here. In August, we saw 65 BWICs and 94 OWICS on Octaura, garnering over 14,300 responses and driving total volume to surge by 227% year over year. This is followed by a similarly active July, with 6.4% of the secondary market trading on Octaura.1

CLOs were the main driver of volume this month with two competing themes at play.

- High dollar prices seem to have motivated equity investors to call deals and managers found success managing those liquidation exercises on Octaura. 92% of that inquiry was in comp as managers stretched to make the return math work.

- On the flip side, with a record number of warehouses open2, managers leaned on Octaura to facilitate ramps. Clients were more inclined to engage out of comp when buying, representing 52% of inquiry.

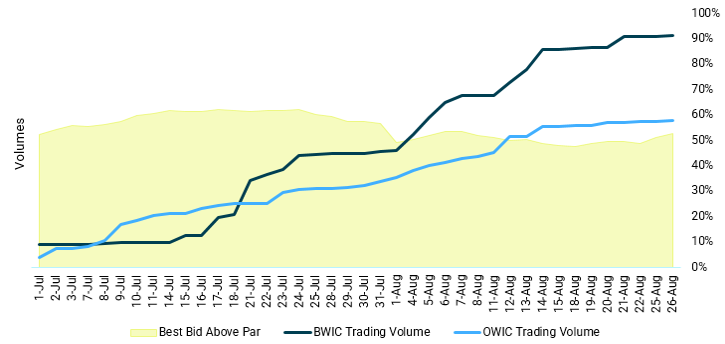

To visualize this, we overlayed cumulative WIC volume across July & August. It’s clear that liquidations outpaced buying, while the percentage of loans bid above par were steady, indicating that prices held up despite stronger selling.

Need a clearer view on the market? Learn more about Octaura’s pricing and liquidity metrics to help inform your trade decisions. Request a demo >

1. Based on the LSTA’s published secondary trading volume for July 2025.

2. Source: Bloomberg: Record Open US CLO Warehouses Indicate Pickup in Deals: Barclays

All market prices, data and other information (including that which may be derived from third party sources believed to be reliable) are not warranted as to completeness or accuracy and are subject to change without notice. Octaura disclaims any responsibility for any loss or damage arising from any reliance on or the use of this material in any way. The information contained herein is as of the date and time referenced only, and Octaura does not undertake any obligation to update such information. This marketing material is provided by Octaura for informational purposes only. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument. All investments involve risk, and past performance is not indicative of future results.