What a difference a month makes

May felt dramatically different from March and April in the loan market. Let’s take a look at four themes we saw on Octaura to illustrate this market dynamic:

- Shifting buy / sell mix

- Out-of-comp inquiry growth

- Higher cost to buy

- Dip in Loans below par

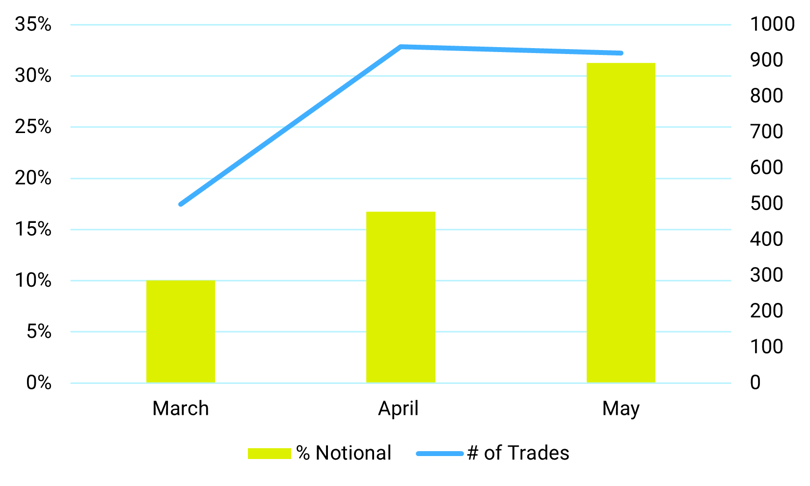

Theme: Shifting buy / sell mix

Outflow-driven selling in March & April gave way to opportunistic and print & sprint buying, particularly in less liquid names in May.

Theme: Out-of-comp inquiry growth

As market conditions changed, customers strategically shifted to engaging dealers directly, out of competition. Single-dealer lists became a popular use case, especially for CLO managers, as a way to balance execution and dealer relationships in their engagement strategy.

Theme: Higher cost to buy

How valuable is it to “zig” when the market “zags”? We compare execution quality, defined as the distance of trade prints to mid, on buys vs sells over the past 3 months. During May’s rallying market, the cost of buying grew to 13 cents while the cost of selling dropped significantly from 23 cents in April to 9 cents in May.

Theme: Dip in loans below par

It may be harder to ramp a new CLO today than it was in early April, but it's still doable. We looked at the percentage of the market traded below par by Liquidity Score to demonstrate how different a CLO ramp exercise looked in May vs the previous two months. Octaura’s Liquidity Scores can help highlight buying opportunities below par.

All market prices, data and other information (including that which may be derived from third party sources believed to be reliable) are not warranted as to completeness or accuracy and are subject to change without notice. Octaura disclaims any responsibility for any loss or damage arising from any reliance on or the use of this material in any way. The information contained herein is as of the date and time referenced only, and Octaura does not undertake any obligation to update such information. This marketing material is provided by Octaura for informational purposes only. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument. All investments involve risk, and past performance is not indicative of future results.